In the heated debates around internet access, municipal broadband and municipal internet are often framed as either the savior of underserved communities or an expensive overreach of local government. While that conversation has been well-worn, what’s less discussed is the increasingly central role utility companies play in building, managing, and monetizing these networks.

Municipal broadband refers to high-speed internet infrastructure that is owned and operated by a local government or public entity, often with the explicit goal of filling coverage gaps left by private ISPs. Municipal internet services can take different forms:

– Retail model when the municipality acts as the ISP directly.

– Wholesale model when the municipality leases the network to private ISPs.

– Hybrid – a mix of both.

In theory, municipal broadband can address the “digital divide” by bringing affordable, reliable internet to residents who are underserved or overcharged by incumbents. In practice, it’s complicated.

Building a fiber network is capital-intensive, often hundreds of thousands of dollars per mile in urban areas and even more in rural terrain. Municipal projects typically rely on bonds, grants, or utility cross-subsidies, creating long-term debt obligations. If adoption rates don’t meet projections, repayment gets tricky. In more than a dozen U.S. states, laws restrict or outright ban municipal broadband, often due to lobbying from incumbent ISPs. Even where it’s legal, political shifts at the city council or state level can stall projects midstream.

Running a broadband network requires a different skill set than running a water utility or a city road department. Without experienced telecom staff, municipalities risk poor customer service, slow maintenance cycles, and outdated technology choices. Private ISPs sometimes respond aggressively by dropping prices, launching fiber upgrades, or lobbying for regulatory restrictions to make municipal networks financially unsustainable.

Utilities are natural stewards of fiber networks?

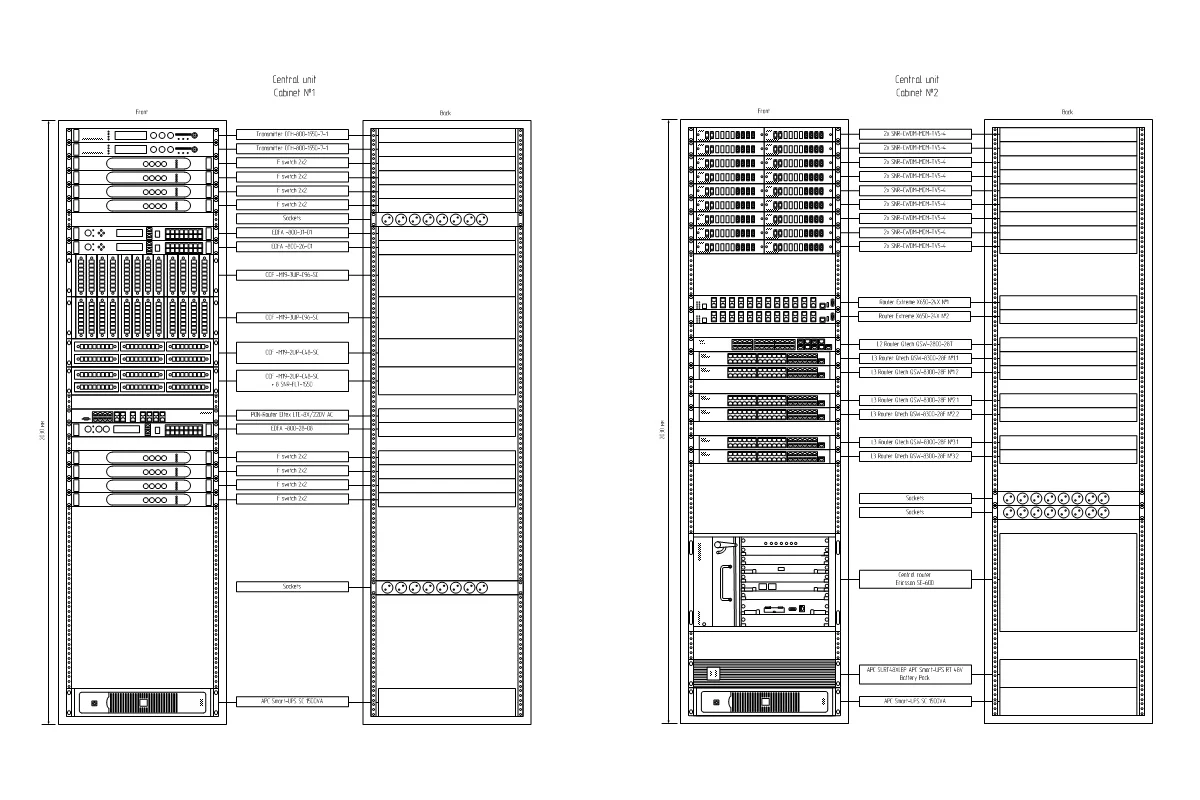

Electric and water utilities already manage physical networks – poles, conduits, rights-of-way, and maintain skilled field crews. This makes them uniquely well-positioned to oversee municipal fiber projects. In many cases, utilities are the “hidden operators” behind municipal broadband initiatives.

Arguments? Existing utility infrastructure and maintenance vehicles reduce construction costs. Utilities have 24/7 dispatch, maintenance scheduling, and outage response systems. As well as billing systems, call centers, and service trucks are already in place.

Utilities often start with “dark fiber” deployments – fiber optic cables with no active service, often running alongside electric lines. These fibers can later be lit for internet traffic. Utility crews handle vegetation management, pole replacements, and storm damage repairs. Fiber maintenance becomes just another line item alongside electrical grid upkeep. Utilities integrate fiber network monitoring into their existing NOCs, enabling proactive fault detection and rapid response.

Is municipal broadband financially viable?

Utilities and municipalities use different models to generate revenue from broadband infrastructure. They sell capacity to ISPs, cellular carriers, and enterprise customers, directly serve residents and businesses, charging monthly fees. And by the way, utilities often already have their own fibers which support operations like smart meters, SCADA systems, etc., reducing operational costs and justifying the investment. Large institutions (schools, hospitals, government offices) prefer such providers and are more willing to sign long-term connectivity contracts rather than with private ISPs, that stabilize revenue.

Of course they have pros and cons. The pros are:

– Professional maintenance and reliable uptime.

– Potential to integrate broadband into essential-service pricing.

– Keeps revenue local rather than sending profits to out-of-state ISPs.

The cons are:

– Telecom regulation can be more complex than energy regulation.

– Risk of diverting utility focus from core services.

– Long payback periods.

But as demand for high-speed internet grows, and as federal funding for broadband infrastructure accelerates, utilities will likely become even more prominent players in the municipal broadband space. They bring operational discipline, asset efficiency, and local accountability. But they also inherit the same challenges: political resistance, fierce competition, and the relentless pace of technology change. For communities weighing municipal internet projects, partnering with a utility can tilt the odds toward success, but only if the financial, operational, and political realities are addressed from the outset.

What works when utilities run the show

So utilities already run the infrastructure. That gives them three big advantages: lower build cost via existing rights-of-way, faster restoration using existing outage workflows, ready-made billing & customer service. Policy tailwinds (e.g., faster pole-attachment timelines) also help new builds and expansions.

But what the build really costs? Published U.S. build estimates for fiber frequently land around $60K–$80K per mile. Attachment and make-ready can be the swing factor (crew time to rearrange existing lines, replace weak poles, tree work), but is definitely faster and cheaper than any private ISP. States increasingly nudge undergrounding in vulnerable zones, which raises up-front cost but can reduce storm OPEX later. Many utility-led builds target O&M of ~2..5% of CAPEX/year.

Five good examples of utility-run municipal networks

1. Chattanooga, TN (EPB), a vertically integrated utility ISP.

The model – electric utility built fiber primarily to modernize the smart grid. It also sells retail Internet.

The outcomes – an independent UT-Chattanooga study estimates ~$2.7B community benefit in 10 years, including outage reduction, new jobs, and proven bandwidth resilience during COVID. ROI here is socioeconomic benefit, not just ISP margin.

2. Longmont, CO (NextLight via Longmont Power & Communications), an utility retail with extraordinary take-rate.

The model – an utility owns and operates retail FTTH network.

Adoption – ~64% take rate on ~47K premises passed which is elite by any ISP standard. Levers used – early charter pricing, strong local brand, and utility’s customer ops.

3. Huntsville, AL (Huntsville Utilities + Google Fiber), a dark-fiber lease.

The model – the utility builds/owns fiber then leases it to an ISP (Google Fiber) that lights and markets services.

Revenue signal – budget documents show multi-million-dollar annual Google Fiber lease income, e.g., $4.6M in FY22, $6.5M in FY23.

Why it’s good – predictable lease cash flow to the utility and the ISP avoids CAPEX. This “dark-fiber” template even gained national attention as a replicable model.

4. UTOPIA/UIA, UT, an open-access utility network at multi-city scale.

The model – cities finance fiber, Utah Infrastructure Agency extends and operates an open-access network where multiple ISPs compete on the same fiber.

The outcome – 2024 UIA financials show city-by-city take rates of ~30% in one completed city, ~25% in another, with ongoing bond issuances and an investment-grade ‘BBB’ on telecom revenue bonds.

Why it works – wholesale revenues are tied to subscriber growth across participating cities, retail competition rides on top.

5. Ammon, ID, and open access utility network.

The model – the city uses Local Improvement Districts (LIDs) so each participating neighborhood/home finances its drop. The residents pick ISPs on a software-defined open-access platform.

Economics – third-party analysis cites ~$1M network investment yielding ~$1.8M municipal cost reduction over 25 years, plus an estimated $4.7M annual GDP lift. The retail plan prices are as low as $9.99/mo for 1Gbit.

How utilities run municipal broadband fiber in Eugene, OR

Let’s take a look at EUGNet – previously referred to as the “Downtown Fiber Project,” EUGNet is an “open access” fiber optic network. It is basically an utility-anchored fiber network. It’s fiber assets are owned/managed by EWEB (Eugene Water & Electric Board). Qualified ISPs lease strands and sell service to end users. The City and Lane Council of Governments (LCOG) are core partners. It’s initial build public funding EDA grant is ~$1.9M toward a project just under $4M. At the same time the city authorized up to $3M for fiber installation eligibility.

The city documentation pegs ~$10K per building to connect, with time-limited municipal subsidies for eligible buildings during the initial build. Eugene chose infrastructure-first (public fiber + private ISP competition) rather than a city retail ISP. That keeps operational risk lower for the city while leveraging EWEB’s utility skill set.

How utilities actually manage it

Asset owner & lessor is EWEB. It manages strands and leases dark fiber to ISPs and other entities, an extension of its long-standing dark fiber program serving schools, public agencies, and now commercial ISPs.

In terms of maintenance, the municipal fiber is treated as an utility asset – mapped, monitored, and maintained alongside other networked infrastructure. LCOG’s Public Agency Network (PAN) and Regional Fiber Consortium provide shared governance/operational frameworks across agencies.

As for pricing signals (regional context), LCOG lists standard strand-mile lease rates (e.g., $14.40/strand-mile private, $6.00/strand-mile public) for consortium fiber – useful to benchmark wholesale revenue for inter-facility routes.

The problems Eugene faced

The one major problem was capital stack complexity. The city combined federal EDA funds with Urban Renewal program to de-risk early CAPEX. And so to overcome first-cost friction, Eugene offered building-connection subsidies of around ~$10K/building window.

By keeping EWEB as neutral owner and allowing competing ISPs, the city avoided building a retail ISP organization while still creating competition on price/performance, still sticking to the open-access principles.

Evidence of outcomes so far

Eugene city and EWEB releases highlight dozens of downtown buildings/businesses connected during the initial phases (e.g., first 20 businesses across 3 buildings as of late 2016, then broader district rollout 2017–2019, and still going in 2025). Among other business connectivity gains – all major utilities and factories are connected via this network. The city frames EUGNet as an open-access economic-development tool, with Urban Renewal as the prime funding vehicle. Outside write-ups describe it as Oregon’s largest open-access fiber footprint downtown.

So how their money works? They run wholesale dark-fiber leases, getting recurring lease revenue per strand-mile and per lateral, they charge lateral/connection fees, and also receive indirect city ROI via Urban Renewal via faster tenant absorption, higher assessed values, and retail sales activity downtown (benefits accrue to the tax-increment district, quantified locally via URA reporting). And lastly, foster anchor & public-sector savings – agencies connected over PAN/consortium fiber often report lower transport costs compared with legacy carriers (seen elsewhere in Lane County and across Oregon public networks).

ROI frame for Eugene (assumptions)

Because EUGNet is open-access (wholesale, not retail), lets assume lease-backed payback plus urban-renewal spillovers rather than ISP ARPU.

Capex to pass 10 multi-tenant buildings – assume $1.2M (laterals, splicing, distribution, permits), plus $100k for electronics & contingencies allocated to the open-access hub.

Wholesale revenue:

– Strand-mile leases to ISPs/backhaul is assumed 6 miles of downtown routes × $14.40/strand-mile/mo × 8 strands leased on average ~$830/mo or ~$10K/yr.

– Building laterals/IRUs are assumed 10 buildings × $10K one-time (mix of paid & subsidized) gets us $100K gross one-time.

– Port/hand-off fees plus cross-connects are assumed ~$1.5K/yr/building average so ~$15K/yr.

– Five-year view (cash only, no URA uplift) should be giving ~$175K recurring + $100K one-time against ~$1.3M CAPEX, which gives ~21% cost recovery in 5 years on wholesale cash flows alone.

– Urban Renewal effects (non-cash to EWEB, but real to the City/URA) considerations – if improved connectivity lifts net taxable value or occupancy such that URA captures ~$150K–$300K/yr in incremental tax-increment, the public-sector payback window can compress materially.

Expansion paths and what’s next for Eugene

There’s definitely council’s appetite to expand beyond downtown, and there has been public discussion of taking EUGNet-style builds to more of the city. Oregon’s planning guidance puts fiber deployments at $1,000–$2,000 per premise in denser areas, rising in sparse zones, which keeps the whole project afloat. Governance tries to keep EWEB as a neutral dark-fiber steward and continues to let multiple ISPs compete. And though open-access discipline is crucial as footprint grows, the future seems promising.

The pros are lower public OPEX risk vs. running a retail ISP, and EWEB specializes in network assets. The funding (EDA + Urban Renewal) is flexible and reduces first-cost shock. The cons are wholesale leases don’t capture full retail ARPU, so the public cash payback is slower without counting URA benefits. Residential scale-out requires a bigger capital plan and different customer-ops capability than a downtown business loop.

City’s authorities foresee next steps in quantifying URA uplift building-by-building to show city-level ROI, not just EWEB cash flow. They want to standardize ISP interconnects & SLAs to speed onboarding and raise wholesale utilization, alongside with leveraging LCOG assets for edge routes and anchoring backhaul.